non filing of income tax return penalty

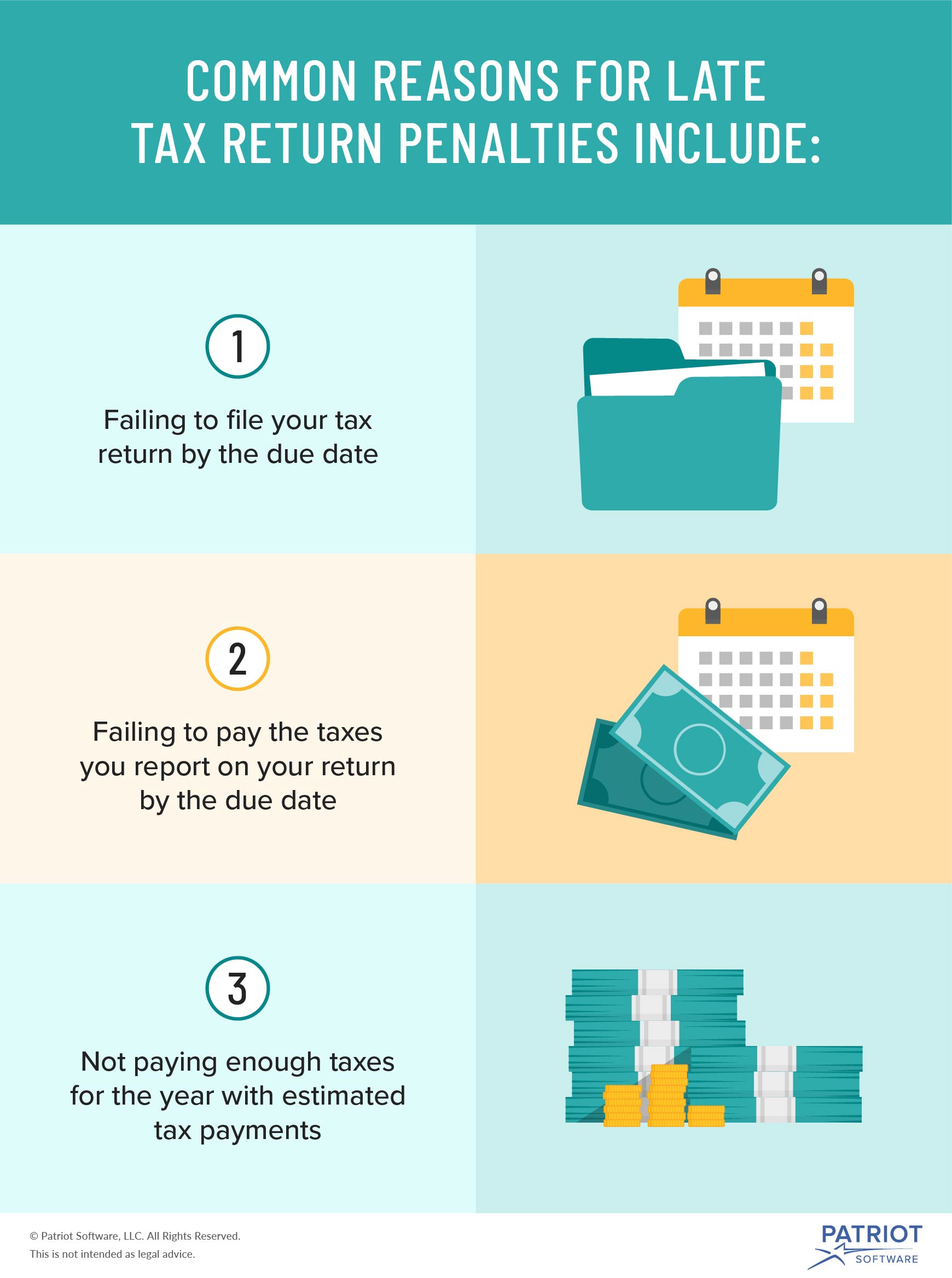

Youll get a penalty if you need to send a tax return and you miss the deadline for submitting it or paying your bill. In such cases Penalty us 270A is for under.

Monday Is Tax Day Here S What Happens If You File Late Oregonlive Com

CLICK HERE CLICK HERE.

. Penalty for non-filing income tax returns wealth statement foreign assetsincome statement active status. 5 of the tax due for each month or part. A new penal regime for non-filing of income tax return has been introduced through amendment in section 182 of the Ordinance.

Penalty - 5 of the tax due or Kshs. What to Know about Vande Bharat 20 What to Know about Vande Bharat 20. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due.

However the minimum penalty shall be Rs10000 in case of individual having 75 per cent or more income from salary and Rs50000 in other case and maximum penalty shall. If undisclosed income admitted during search 10 as penalty. Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties.

What is the Penalty for Late Filing of Income Tax Return. Failure to file your Form P1 together with original AuditedCertified Statement of Accounts by the due date is an offence. 2If undisclosed income not admitted during search but disclosed in the return of income and taxes is paid.

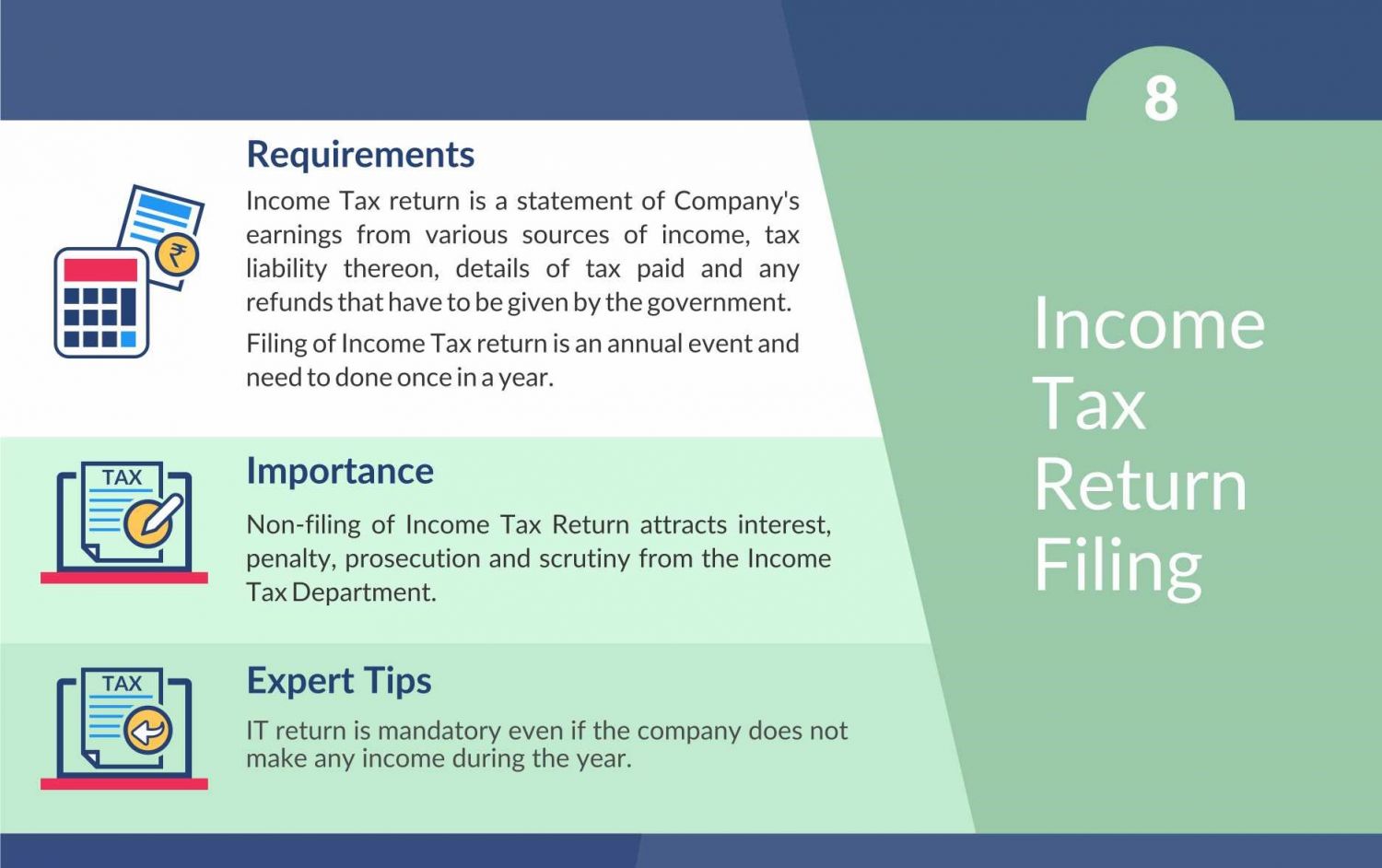

Penalty for late filing. ITR Late Filing Penalty - Filing your tax returns after the due dates has more consequences than just penalty. If you have unpaid taxes that are outstanding to the income tax department and you have not filed your tax return on or before the due date you will be charged with section.

The IRS charges a penalty for various reasons including if you dont. Section 1821 Offences and penalties Non-filing of Income Tax. Such person shall pay a penalty of Rs5000 if the person had already paid the tax collected or withheld by him within the due date for payment and the statement is filed.

If your total income is more than 5 Lakhs return is filed after the due date Fee Rs. If you owe taxes and fail to pay them you. If the total income is less than or equal to 5 Lakhs return is filed after the due.

Here is one more judgment wherein it is held that non filing of income tax return cannot be the reason for denial of registration us 12AA of the Income Tax Act 1961. It impacts the carry forward and set off of losses and time for. As per section 276C if a person wilfully.

A person who fails to file return within due date. Taxpayers who dont meet their tax obligations may owe a penalty. Generally the Income Tax department does not levy any penalty of non-filing of ITR upon individuals and organisations with total gross income below the exemption limit.

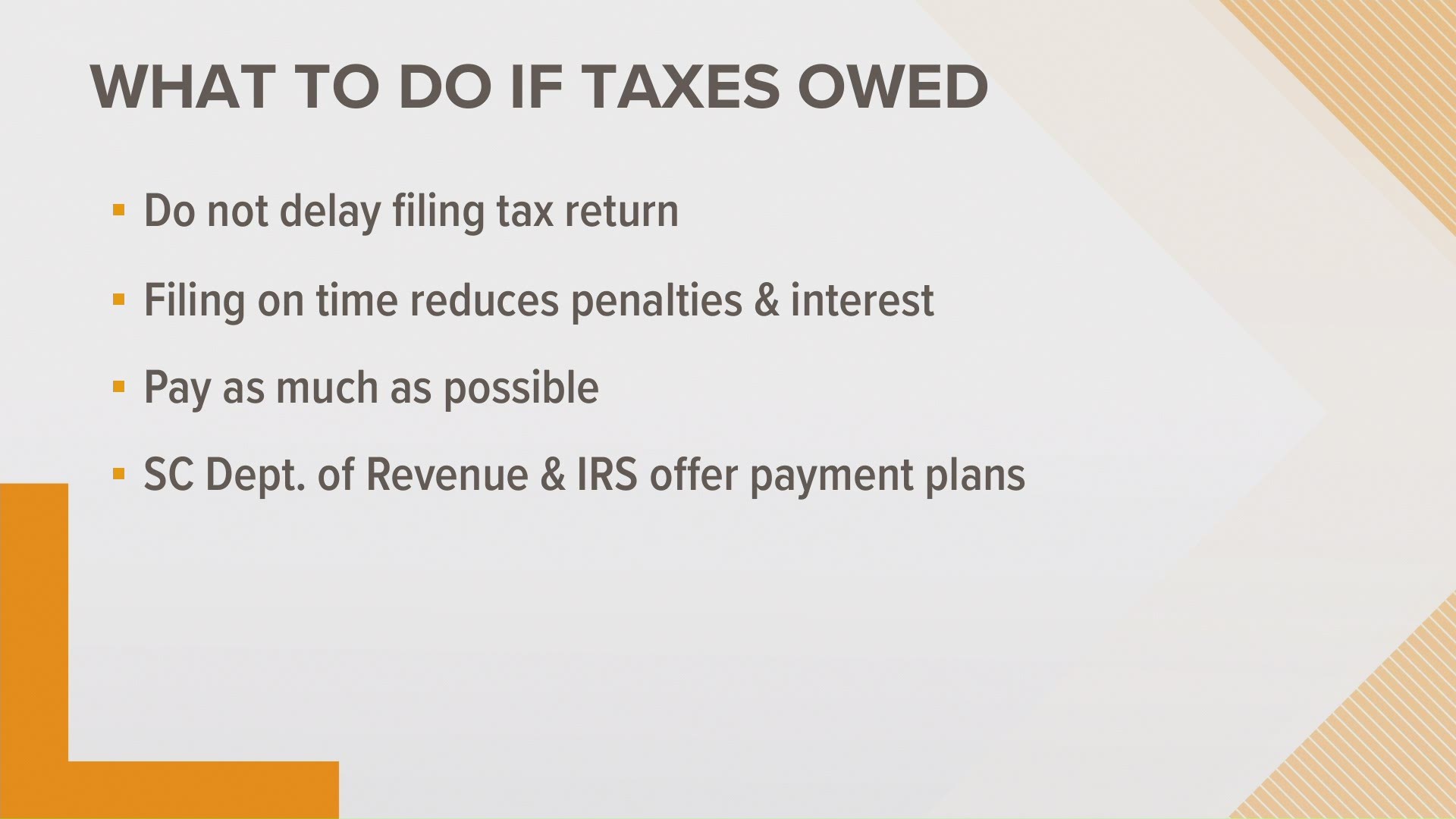

File your tax return on time Pay. Youll pay a late filing penalty of 100 if your tax return is up to 3 months. PENALTIES FOR LATE FILING OF TAX RETURNS.

Section 276C provides for punishment in the case of wilful attempt to evade tax penalty or interest or under-reporting of income. Penalty - 5 of the tax due and an interest of 1 per month. Offence - Late filing of Income tax company or partnership returns.

Consequences for late or non-filing of tax returns. If your return was over 60 days late the minimum Failure to File Penalty is 435 for tax returns required to be filed in 2020 2021 and 2022 or 100 of the tax required to be. The penalty charge is.

If you file late we will charge a penalty unless you have a valid extension of time to file. If you have taxable income and do not file the return of Income you may end up paying penalty for concealment of Income.

What Happens If You Don T File Income Tax Return Itr Penalty Or Even Jail Mint

Penalty For Filing Taxes Late How To Prevent Internal Revenue Code Simplified

What Happens If You Don T File Taxes Is Not Filing Taxes A Crime Legalmatch

What To Do When You Miss A Filing Deadline Ppt Download

Late Filing Or Late Payment Penalties Missed Deadline 2022

Explained All About Belated Filing Of Income Tax Returns

Penalty For Late Filing Of Income Tax Return Ay 2019 20

Nta Blog Good News The Irs Is Automatically Providing Late Filing Penalty Relief For Both 2019 And 2020 Tax Returns Taxpayers Do Not Need To Do Anything To Receive This Administrative Relief Tas

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Irs Notice Cp215 Notice Of Penalty Charge H R Block

Last Date To Filing Income Tax Return And Penalty For Non Filing Taxation

Know Penalty For Filing Returns After 31 August 2019 And Repercussions

What Really Happens When I Don T File For My Tax Return Incometax Tax Taxseason Money Finance Irs Taxevasion Tax Return Income Tax Taxact

Penalty U S 234f Fees For Late Filling Of Itr

Penalty Relief For Late Filed Income Tax Returns Wilke Associates Cpas

The Consequences Of Not Filing Taxes

Tax Returns Due May 17 Last Day To File Taxes Without Penalty King5 Com

Ali Fahad Co Income Tax Return Is Mandatory To File Individuals Firm And Companies Who Are Filing Their Income Tax Returns Are Getting Benefits From Different Sector Of The Country